All time high in February 2015 amidst optimism of further gains.... 20 month low in January 2016 with fears of further crash! That's how dynamic and fast situations and views change. A lot would have been written and said, listing reasons for the same.

Indian equity markets are now back to the levels of May 2014, when in a historic verdict, Mr Narendra Modi was sworn in as India's Prime Minister. Extreme optimism led to the markets hitting an all-time high of 9100* for the Nifty. And who would have imagined that in a span of just 20 months, various factors would lead to Nifty falling back to the pre-election levels of 7300, with extreme pessimism being the order of the day. (*Source: Bloomberg)

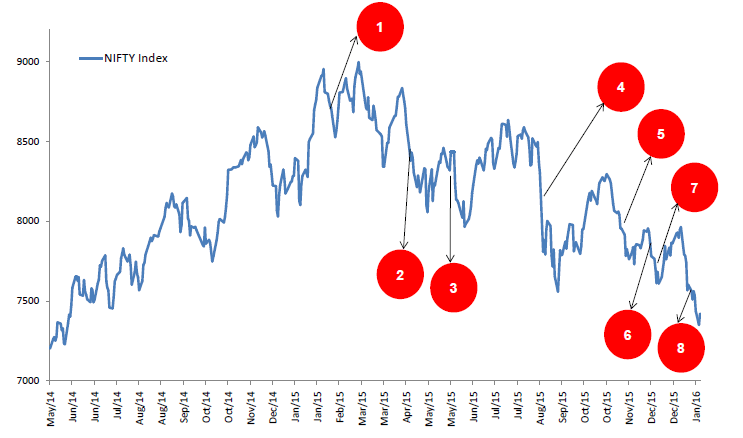

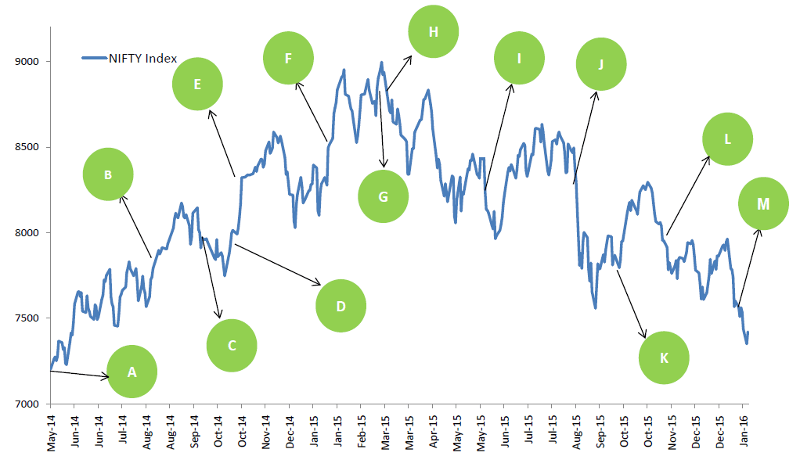

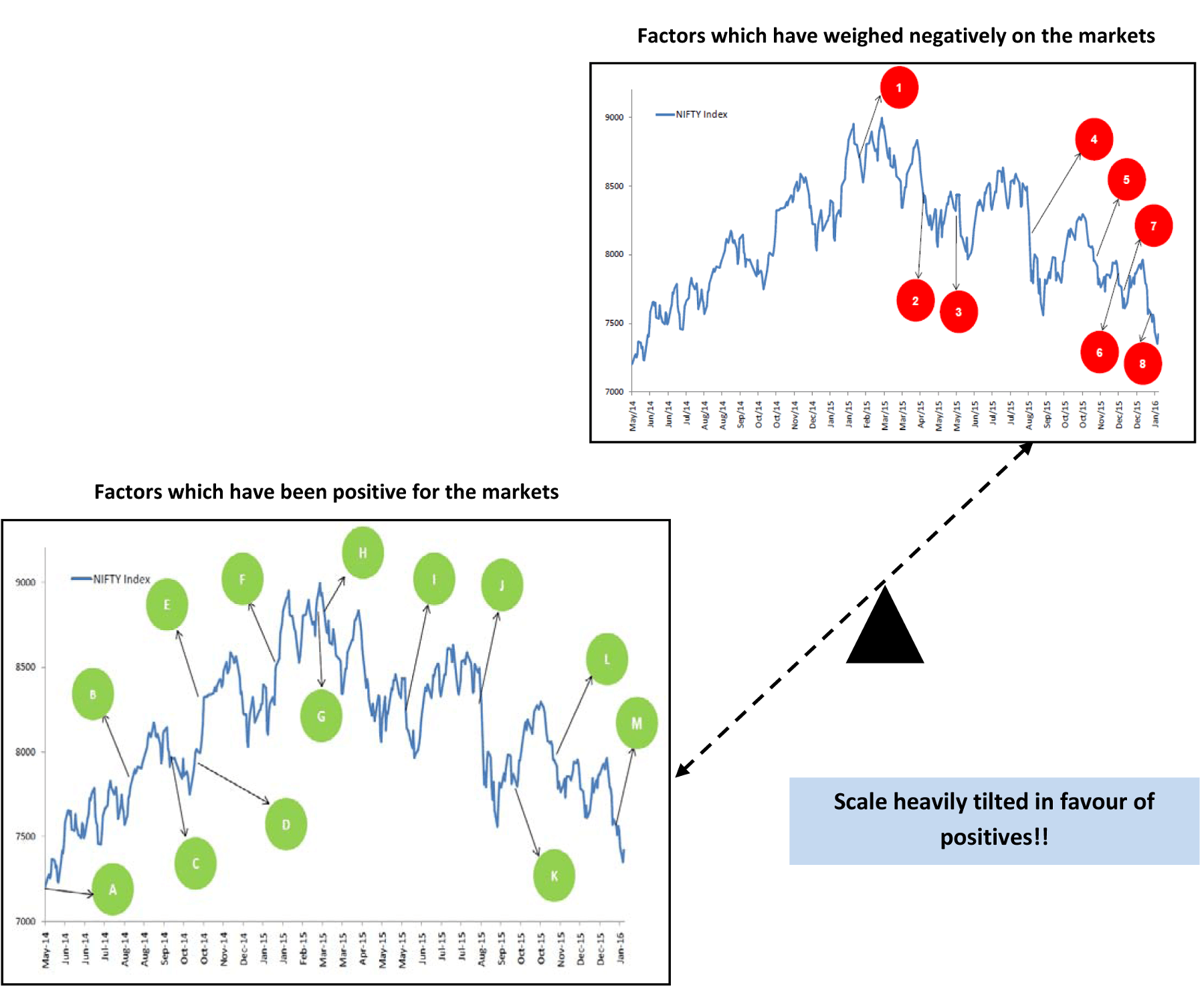

This is an attempt to present our take on the same in a very simplistic manner. We start with a simple chart displaying the factors that have had a negative impact on the markets (chart 1). After discussing the same, we again use a chart displaying the positives over the last 20 months (chart 2).

The conclusion is clear: while Indian economy has faced multiple challenges and headwinds, there have been more structural positives that India has been blessed with over this period. As soon as financial stability returns in global markets, the balance-of-scale, heavily tilted in favour of positives will come to work and lend stability and positivity to Indian equities.

Chart 1: Factors which have negatively weighed on the market

Source: Bloomberg

Chronological information of the negative developments annotated in the above chart

| Annotation |

Date |

Event / Policy |

Comment |

| 1 |

Jan-15 |

BJP loses Delhi elections |

First major loss of the BJP party since coming into power at the central level makes equity markets jittery |

| 2 |

Apr-15 |

Fears of Greece Exit |

Talks between the newly elected Greece government and the EU authorities to secure a bailout package fails, creating fears of Grexit and the disintegration of the European Monetary Union |

| 3 |

Jun-15 |

IMD Monsoon Forecast |

IMD forecasts 12% monsoon deficit, marking the second year of drought in the country |

| 4 |

Aug-15 |

EM sell-off led by China |

Surprise CNY devaluation by the Chinese monetary authorities along with the stock market rout leads to a broad sell-off in EM assets |

| 5 |

Nov-15 |

BJP loses Bihar elections |

Defeat of BJP in Bihar raises fears that the reform momentum will be stalled and that the government will turn populist |

| 6 |

Dec-15 |

Bank NPA issue/ Legislative Logjam |

RBI governor Raghuram Rajan announces that banks which are saddled with huge NPAS must clean-up their balance sheets by March-2017. The winter session of parliament is a complete washout with no key legislative bills like GST passed |

| 7 |

Dec-15 |

Fed policy meet |

Fed policy tightening fears lead to sell-off across global equity markets |

| 8 |

Jan-16 |

China stock market rout and oil crash |

Sharp fall in Chinese equity markets and the crash in oil prices to less than US$30/bbl raises fears of a global recession |

Source: Various Media Reports, IIFL and JPM

Elaborate reasons for the market fall:

Global risk aversion:

- China: Chinese economy has slowed to the lowest levels in 25 years. There are fears pertaining to the possible hard landing in China, as reflected in the sharp drop in Chinese stock market. In line with the efforts to make the currency more flexible, the PBoC has depreciated the CNY 4% to 5%. The fear of hard landing and sharp devaluation of CNY has caused panic in the global market.

- Our take: The Chinese economy is rebalancing as it is becoming more inward looking rather than export dependent. In this adjustment process, they need a much better foreign exchange policy. They are making all the right efforts toward this but the worries related to sharp devaluation in CNY and/or hard landing in China may be overstated.

- Oil: The persistent weakness in oil prices continues to exert its negative influence on all markets, especially credit markets. It is also leading to short-term withdrawal of financial investments by oil producing Sovereign Wealth Funds.

- Our take: Prices have sharply fallen to $27 per barrel which is below the cash cost of a number of major producers. Thus, at these levels we begin to see significant production capacity going offline, which should then set the stage to stabilise the energy sector. Stable and rising energy markets should be positive for global risk environment. Also for India, lower crude is eventually beneficial than higher crude prices.

- Fed tightening: The US Central bank has eased their policy by 25 bps in December, reversing the 7 years of monetary support. Markets are worried about any sharp policy tightening by the Fed, which can put pressure on global cost of capital.

- Our take: While the US economy is doing well, the recent bout of risk aversion and deflation would mean that the Fed could postpone the incremental tightening as financial conditions have materially tightened in the US as well. Any delay in Fed tightening would be taken as positive surprise. Also, other Central banks like ECB, PBoC, BoJ could soften their policy stance as deflation fears have mounted.

Local concerns:

- Monsoon: India has had two back to back sub-par monsoons leading to rural slowdown.

- Our take: Outlook for monsoons in 2016 is positive as India has never seen 3 consecutive years of drought. Meanwhile, global forecasters such as the Japan Agency for Marine-Earth Science and Technology said there was a probability of La Nina developing in 2016. Historically, La Nina results in better than normal monsoon in India.

- Legislative logjam: Due to the ongoing conflict between the Centre and the opposition parties, there has been a severe legislative logjam. This has made the reform process tardy leading to disappointments.

- Politics (state elections defeat): After a dream run till 2014, BJP suffered two meaningful defeats in 2015 in Delhi and Bihar elections. This has impacted the positive sentiments as investors worry about the difficulty that the Government faces to push the reforms agenda forward.

- Our take: Government has shown resolve to continue with the reforms agenda despite legislative hurdles. Further, any normal functioning of the Parliament would be considered as positive surprise by the market. Also, in FY17, there are no critical state elections for the BJP, so they may use this slack period to improve upon the reformist agenda. The upcoming budget could be a platform to showcase the resolve.

Cleansing up of the system

- NP as of the banking system: Government/RBI has expedited the efforts to recognise bad assets for a long pending overhaul of the banking system.

- Curb on the parallel economy: There is a clear intent towards bringing more transparency in the system. This has affected the near term sentiment as well as growth momentum.

- Our take: While this is hurting growth in the near term, it is likely to considerably improve the quality of India's macroeconomic profile over the medium term. The share of organised sector shall improve. Once the system becomes lean and transparent, the eventual recovery is likely to be far more sustainable.

Chart 2: Factors which have been positive for the markets

Source: Bloomberg

Over the last 20 months, there have been various positives in the form of progress made by both the Government as well other favourable developments. Once the dust settles, these positives could come to the fore and redeem themselves through superior market performance.

It is interesting to note that India has added over INR16 lakh crores in GDP over the last 20 months under the new regime. Yet India’s market capitalization to GDP has declined from 70% to 68% in the same period.

Chronological information of the positive developments annotated in the above chart

| Annotation |

Date |

Event / Policy |

Comment |

| A |

May-14 |

Narendra Modi led BJP party's historic win |

Most decisive political mandate in India after 3 decades with the BJP government winning and emphatic 282 seats under the leadership of Narendra Modi |

| B |

Aug-14 |

Jan-Dhan Yojana |

Financial Inclusion: To ensure access to financial services, namely banking savings and deposit accounts, remittance, credit, insurance and pension in an affordable manner |

| C |

Sep-14 |

"Make in India" |

To promote manufacturing in India with the intent of skilling the workforce and generating employment in manufacturing intensive sectors |

| D-E |

Oct/Nov - 14 |

Sharp fall in crude prices / Deregulation of diesel prices / DBT scheme |

To reduce subsidy burden, government deregulates diesel prices. Crude oil falls sharply in November to less than US$80/bbl. In order to prevent leakages, the government starts the process of shifting all subsidy payments to direct benefit transfer (DBT) framework, starting with LPG subsidy |

| F-I-K |

Jan/Jun/Sep - 15 |

Rate easing by the RBI |

January-2015 marked the start of a rate easing cycle by the RBI. The RBI cut 125bps cumulatively in CY15 |

| G |

Feb-15 |

First full budget by the new government |

The government presents a reformist budget with significant thrust on public capex (roads, railways, defence). Finance Minister Arun Jaitley lays roadmap to bring down the corporate tax rate from 30% to 25% in the next five years |

| H |

Mar-15 |

Slew of legislative reforms |

Higher FDI in insurance, defence and railway infrastructure. Auction of coal mines. Other mineral mines like manganese, iron-ore and bauxite to be also auctioned |

| J |

Aug-15 |

Smart Cities, Project Indradhanush |

Smart Cities: Government unviels a list of 98 cities with the aim to promote integrated planning for urban India. Also, announces Project Indradhanush, a seven-pronged strategy to revamp function of public sector banks |

| L |

Nov-15 |

Project UDAY, FDI liberalization, Gold Monetization Scheme |

Project UDAY to revive the financial health of DISCOMs. FDI liberalization in 15 major sectors. Gold monetization scheme to convert household physical savings of gold to productive financial savings |

| M |

MJan-16 |

Crop Insurance Scheme |

New Crop insurance scheme announced to alleviate rural stress |

Source: Various Media Reports, IIFL and JPM

What can go right over the next 24 months?

We all know what can go wrong. China, Oil, US Fed, risk aversion, Indian banks NPA problem, slow growth, etc. But it makes sense to at least think about the positives which can happen.

There are a number of reforms/developments which are already in place and it’s just a matter of time when they will start to come into play.

- Two key legislative bills (which could clear in coming sessions): Good and Services Tax (GST) and Bankruptcy Code. It is "when" rather than "whether"

- Dedicated Freight corridor (DFC) and Delhi Mumbai Industrial Corridor (DMIC)

- Skill India / Digital India / Start-up India: All these measures will push forward the Make in India policy

- Reduction in corporate tax rate from 30% to 25%

- Reduced interest rates

- Ease of doing business – Cutting down on red tape

- Curtailing the parallel money (Black Money): boosting the organized sector

- Full benefits of lower crude, leading to long-term competitiveness for Indian manufacturing sector, besides a strong country Balance Sheet with lower twin deficits

- Normal monsoon, leading to rural economy adding to GDP growth

- Visible impact of huge government spending in areas of railway, defence, roads, power, etc

- Cleansing of bank books, removing the overhang and uncertainty and allowing banks to focus again on core credit growth

- Expectations have toned down meaningfully and any uptick might lead to big surprises and reaction

- A possible development and growth focused Union budget on February 29th

There is a possibility that most of these factors will coincide together in a few quarters resulting into a virtuous cycle. None can deny that the intention from the government side is very strong. It's a matter of time that the "talk" gets converted into "walk".

Also, history suggests that a sharp fall in the market has proven to be a good opportunity for the long term investors, as subsequent returns have been quite favourable over the next 1 to 2 years. The below mentioned table substantiates this.

Table: 2 year return after every major fall in Sensex

| Peak date |

Bottom date |

Sensex High |

Sensex low |

% fall from high |

1 year return |

2 year return |

| Feb-01 |

Sep-01 |

4,462 |

2,594 |

-42% |

16% |

60% |

| Feb-02 |

Oct-02 |

3,758 |

2,828 |

-25% |

66% |

100% |

| Jan-03 |

Apr-03 |

3,416 |

2,904 |

-15% |

93% |

124% |

| May-04 |

May-04 |

5,772 |

4,227 |

-27% |

47% |

189% |

| May-06 |

Jun-06 |

12,671 |

8,799 |

-31% |

66% |

83% |

| Jan-08 |

Mar-08 |

21,206 |

14,677 |

-31% |

-41% |

14% |

| Oct-08 |

Oct-08 |

13,203 |

7,697 |

-42% |

123% |

166% |

| Jan-11 |

Dec-11 |

20,664 |

15,135 |

-27% |

28% |

38% |

| May-13 |

Aug-13 |

20,443 |

17,448 |

-15% |

46% |

62% |

| Mar-15 |

Till Now |

30,024 |

23962* |

-20% |

- |

- |

* Price as of Jan 21st 2016 * All % changes are absolute and not compunded

Source: Bloomberg

Past performance may or may not sustain in the future.

More positives than negatives

Source: Bloomberg

To conclude, while there are multifold challenges, there are more than enough positives which will enable the growth to meaningfully recover in the coming quarters. In these volatile times, investors tend to look at glass half empty rather than half full. As stated above, positives outweigh the negatives and provide an excellent opportunity to increase allocation in equities from long term perspective. As legendary investors always say, "BUY when there is blood on the street".

"BE POSITIVE".

Disclaimers:

The information herein below is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since RCAM has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; RCAM does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements & assertions contained in these materials may reflect RCAM’s views or opinions, which in turn may have been formed on the basis of such data or information.

The Sponsor, the Investment Manager, the Trustee or any of their respective directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such data or information. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and opinions given are fair and reasonable, to the extent possible.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Recipients of this information should rely on information/data arising out of their own investigations. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

None of the Sponsor, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material.

The Sponsor, the Investment Manager, the Trustee, any of their respective directors, employees including the fund managers, affiliates, representatives including persons involved in the preparation or issuance of this material may vary from time to time, have long or short positions in, and buy or sell the securities thereof, of company(ies) / specific economic sectors mentioned herein, subject to compliance with the applicable laws and policies.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.